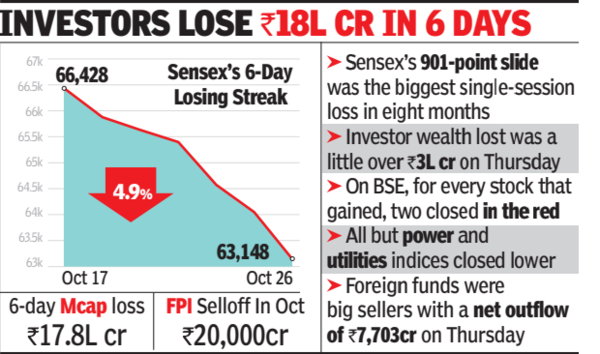

In last six sessions, sensex has lost nearly 3,300 points or 5% of its value as foreign funds have sold heavily.During these six sessions, investors’ wealth loss was a staggering Rs 17.8 lakh crore with BSE’s market cap now down at Rs 309 lakh crore.

On the NSE, the Nifty has lost nearly 1,000 points or 5% to its current close at 18,857 points. Thursday’s session started on a weak note with the sensex down about 400 points and steadily lost steam through the day to hit an intra-day low at 63,093 points, closing just a tad above that level. 26 of the 30 sensex constituents closed lower. Among the index laggards, HDFC Bank, Reliance Industries and Bajaj Finance contributed the most to the day’s high triple-digit loss, BSE data showed.

According to Naveen Kulkarni, chief investment officer, Axis Securities PMS, the recent correction in the market has been led by two primary factors: Geopolitical tensions and the rising government bond yields in the US. “These challenges have a long-term impact on equities, but domestic factors in India remain encouraging. (In the current market stocks) that are overvalued and lack quality should be sold, while quality businesses can be accumulated at these levels.”