The day’s selling was led by foreign funds that recorded a net outflow of Rs 4,237 crore, BSEdata showed.On the other hand, domestic funds were net buyers at Rs 3,569 crore. On theNSE, Nifty closed 160 points down at 19,122 points.

According to Shrikant Chouhan of Kotak Securities, markets extended their fall as banking, IT stocks led the slump in the backdrop of persisting global turbulence. “Higher valuations of Indian stocks have been a concern and the current global turmoil is allowing investors to reduce their equity exposure.”

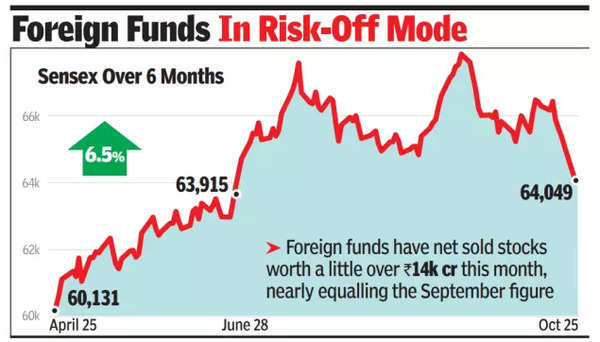

In the last few weeks, a host of global factors have been weighing on investors’ sentiment globally, pulling down prices of stocks and bonds. The start of a war between Israel and Hamas, extreme volatility in crude oil prices and galloping US government bond yields have combined to leave global investors jittery. These factors, in turn, have led to a ‘risk-off’ sentiment among investors globally, meaning they preferred to sell risky assets (that included stocks from emerging markets like India) and stay invested in low-risk assets like dollar and gold, market players said.

This has led to strong selling by foreign portfolio investors in the Indian market. Data from CDSL and BSE showed that so far this month FPIs have net sold stocks worth a little over Rs 14,100 crore, nearly equalling the September figure. This has also put pressure on the rupee, which, despite support from the RBI, is now trading near its all-time low level of 83.28-per-dollar.

The slide in the sensex in the last five sessions have left investors poorer by about Rs 14.8 lakh crore with BSE’s market capitalisation now at Rs 312.1 lakh crore, official data showed. Infosys, HDFC Bank and HDFC Bank contributed the most to the sensex’s slide, BSE data showed. On the other hand, SBI, Tata Steel and four other stocks cushioned the fall, but only marginally.