Among the sensex constituents, Axis Bank, Bharti Airtel and ICICI Bank contributed the most to the day’s gains, while selling in stocks like NTPC and UltraTech Cement limited gains to some extent, BSE data showed.

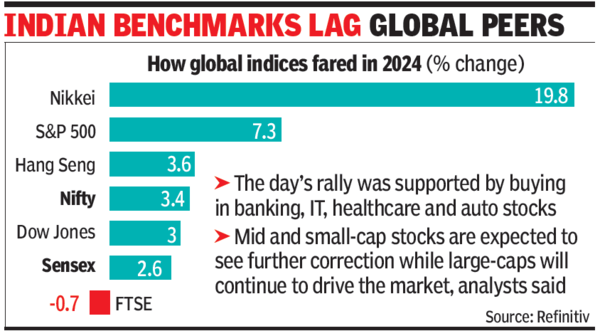

According to Siddhartha Khemka, head (retail research), Motilal Oswal Financial Services, domestic equities made a comeback after a minor pause and continued to make new highs. “Positive up-move was supported by buying in stocks from banking, IT, healthcare and auto sectors. The broader market, however, continued to witness selling, with Nifty Midcap 100 down 0.5% and Nifty Smallcap 100 down 2%.”

Going ahead, mid and small-cap stocks are expected to witness correction.

“We expect large-caps to drive the market in the near term while mid-cap and small-cap stocks could remain under pressure,” Khemka wrote in his post-market note.

The impact of heavy selling in stocks outside of sensex and Nifty was seen in the dip in investors’ wealth. Despite the upward move in leading indices, BSE’s market cap dipped by Rs 1.6 lakh crore to Rs 398 lakh crore, official data showed.

The day’s buying in large-caps was equally helped by foreign and domestic funds, BSE data showed. While foreign funds were net buyers at Rs 2,767 crore, domestic institutions were net buyers at Rs 2,150 crore.

In Thursday’s session, there could be some positive reaction to US Federal Reserve chair Jerome Powell’s statement that the central bank could go for a rate cut later in the year. In early trades in the US on Wednesday, most leading indices as well as govt bonds were up.

Mahindra promoter’s arm to sell 0.8% in company

Prudential Management & Services, a promoter group entity of the auto major Mahindra & Mahindra will sell about 0.8% of the company through block deals on Thursday, sources said. Promoters currently hold 19.3% in the company, BSE data showed. The promoters will receive about Rs 1,778 crore (about $215 million) through this deal.