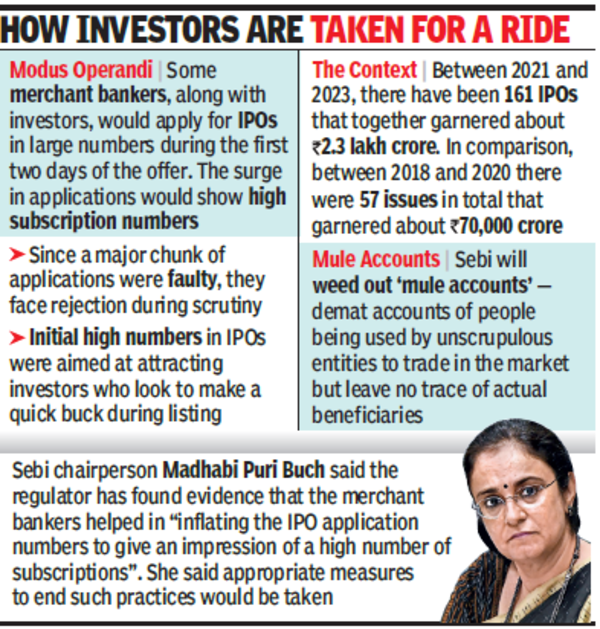

Sebi chairperson Madhabi Puri Buch said the regulator has found evidence that the merchant bankers helped in “inflating the IPO application numbers to give an impression of high number of subscriptions”.She said Sebi is scrutinising IPO-related data and will take appropriate measures to end such practices. She said there could be some changes to policies related to public offers.

Explaining the modus operandi, sources said the merchant bankers, along with a bunch of investors, would apply for IPOs in large numbers during the first two days of the offer and would show high subscription numbers. However, these faulty applications were rejected when scrutinised before the final tally is published and allotments are made. Initial high numbers in IPOs attract a large number of investors who look to make a quick buck during listing.

Scanning through data, Sebi has identified the merchant bankers who are involved in such fudging. There are “frequent names occurring in such malpractices,” she said. “Therefore, in the interest of investors, we will be required to both review policy as well as (start) enforcement actions,” Puri Buch said.

The comments from the Sebi chief came in the backdrop of a surge in the number of IPOs in recent years. Between 2021 and 2023, there have been 161 IPOs that together garnered about Rs 2.3 lakh crore. In comparison, between 2018 and 2020, there were 57 issues in total that garnered about Rs 70,000 crore, official data showed.

Sebi is also scanning through data to weed out ‘mule accounts’ – demat accounts of people being used by unscrupulous entities to trade in the market that leave no trace of actual beneficiaries.

The Sebi chief was speaking at an event arranged by the Association of Investment Bankers in India. At the same conference, Sebi whole time member Anant Narayan G said that the regulator was working on some changes to the regulations for AIFs so that they could pledge shares of investee companies to raise funds, at least for infrastructure companies. Such moves could help in faster capital formation in the economy, he said.