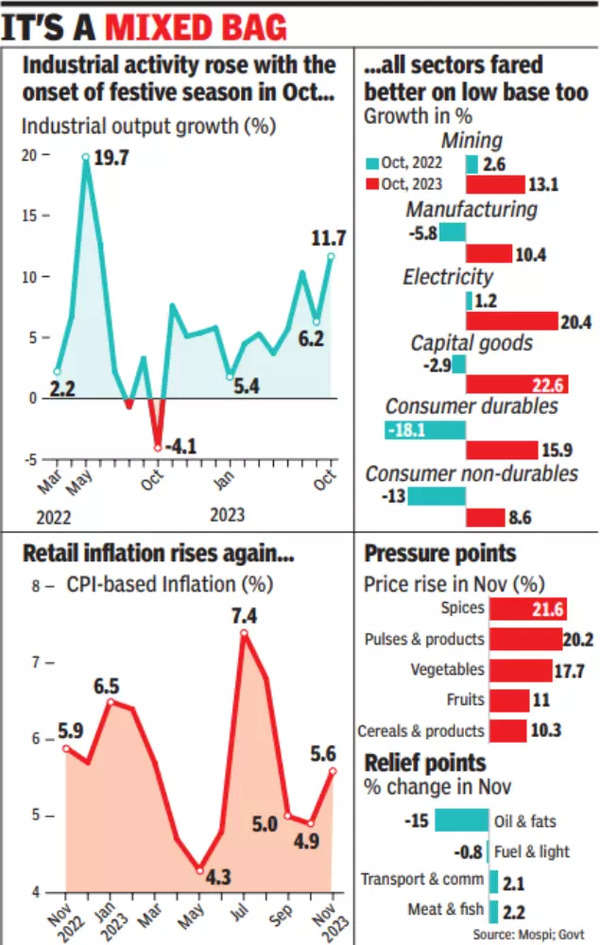

Inflation, as measured by the consumer price index (CPI), rose an annual 5.6% in November, higher than the 4.9% in October but marginally lower than the 5.9% recorded in November 2022.The food price index rose to 8.7% during the month from 6.6% in October. Rural inflation was higher at 5.9% while urban was at 5.3%.

Vegetable prices soared 17.7% in November, while pulses shot up 20.2%. Data showed onion inflation surged nearly 87% in November from 1.7% in June. RBI governor Shaktikanta Das in his monetary policy statement last week had cautioned that there is no immediate prospect of a policy “loosening”, and warned of uncertainties in future inflation management, mainly due to unpredictable food prices, and had anticipated elevated Consumer Price Index (CPI) data for November.

“Given the lingering uncertainty around Kharif production and rabi sowing prospects, high food prices cannot be shrugged off as entirely transient and could further feed into the inflationary expectations. Hence, supply-side interventions by the government become crucial at this juncture to ensure sufficient buffer stock of essential food items,” ratings agency CareEdge said in a note. The Centre has already taken some steps such as banning onion exports and restricting the use of sugarcane for ethanol to calm price pressures.

“An unfavourable base is further expected to push CPI inflation higher around 5.8-6% in December. However, With the arrival of fresh crops in market during January-March, the headline inflation could ease to 5.1% by the fiscal year end. For the full fiscal year, we expect inflation to average at 5.4% with risks tilted to the upside,” the agency said.

Separate data showed IIP growth rebounding in October after the upwardly revised 6.2% in September. The capital goods sector, a key gauge of investment activity, rose 22.6% during the month compared to the contraction of 2.9% in October last year. The infrastructure and construction sector rose 11.3% in October compared with 1.7% growth last year. Several data points including PMI manufacturing have pointed to robust recovery in the sector.

“While high reading came on a low base (IIP was -4.1% in October last year), activity rose sequentially with onset of festive season. However, there are signs of a slowdown aheadThe RBI’s consumer confidence survey of December showed weakening in future expectations,” said D K Joshi, chief economist at Crisil.