The advisory ahead of elections comes along with the recommendation to step up efforts to increase own tax revenue by states through measures such as higher stamp duty and registration fees, in addition to enhancing non-tax revenue by raising charges.During the assembly elections there has been a proliferation of freebies with political parties doling out benefits to win over voters.

In several states, Opposition parties led by Congress, have sought to dismantle the National Pension System, where the employee and the government contribute, and revert to OPS, where the state bears the entire burden and provides an assured pension of 50% of the last pay drawn.

“Internal estimates suggest that if all the state governments revert to OPS from NPS, the cumulative fiscal burden could be as high as 4.5 times that of NPS, with the additional burden reaching 0.9% of GDP annually by 2060. This will add to the pension burden of older OPS retirees whose last batch is expected to retire by early 2040s and, therefore, draw pension under the OPS till the 2060s,” the report said.

Amid moves by the Opposition ruled states, the Centre too has set up a panel to examine how a win-win deal for the government and employees can be worked out without returning to OPS.

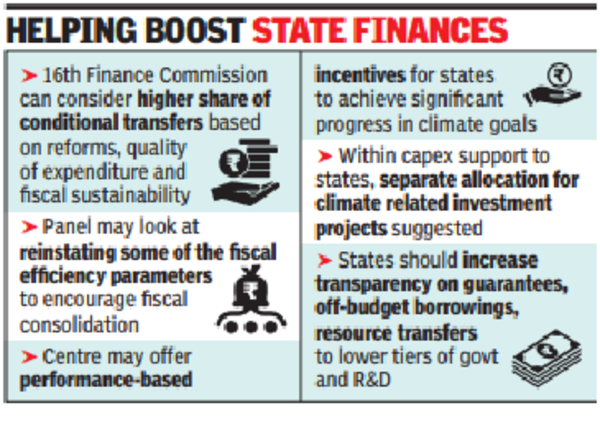

RBI’s annual report card of states has also proposed that the 16th Finance Commission should reinstate fiscal efficiency parameters to encourage fiscal consolidation, among other recommendations for the panel that is set up every five years to look at state finances (see graphic).

For the first half of the current financial year, RBI has estimated that the gross fiscal deficit remained higher, largely due to lower growth in revenue receipts and robust growth in capex, although the growth in revenue expenditure has moderated. It noted that there is deceleration in revenue receipts due to high base as also the withdrawal of compensation cess on GST. For the full year, however, RBI is hopeful of the targets being met. “States’ fiscal outlook remains favourable in view of the resilient domestic economic activity as well as their consolidation efforts,” it said in the report released on Monday.

The document has called for an improvement in tax administration to check evasion and improve their own tax revenue collection so that the fiscal capacity of states is augmented. Apart from excise and property, it has also called for a relook at the levies on automobiles. Mechanisms to curb illegal mining have also been proposed to shore up revenue.

Besides, it has recommended rapid asset monetisation to help fast-track infrastructure creation and liquidation of state PSUs to reduce losses.