NEW DELHI: Walmart-backed PhonePe’s revenues increased by 77% year-on-year to Rs 2,914 crore on a consolidated basis in FY23. The surge in revenues was helped by market expansion in the digital payments space and launch of new products and businesses like insurance distribution and smart speakers, the company said in a statement on Wednesday.

EBITDA losses for the fintech firm’s standalone PhonePe India entity which houses its payments business shot up to Rs1,755 crore in FY23 against losses of Rs 1,612 crore reported in FY22.

EBITDA refers to earnings before interest, taxes, depreciation and amortisation. Excluding Esop (employee stock ownership plan) costs, EBITDA stood at a positive Rs159 crore in FY23 compared to losses of Rs 455 crore in the year-ago period. “Substantial Esops were granted in FY23 towards the corporate restructuring and as one-time rewards for setting up and incentivising new business,” the company said.

Flipkart employees were given a one-time payout of around $700 million as part of separation of PhonePe from the Flipkart Group. The Bengaluru-based firm said that its payments business is “moving towards positive EBITDA (before Esop costs).”

PhonePe said that its market share in terms of UPI total payments value (TPV) stood at 50.54% as of March 2023. With a valuation of $12 billion, the firm which is counted as India’s most valued privately held fintech startup shifted its domicile to India from Singapore in the last financial year and also announced its separation from Flipkart.

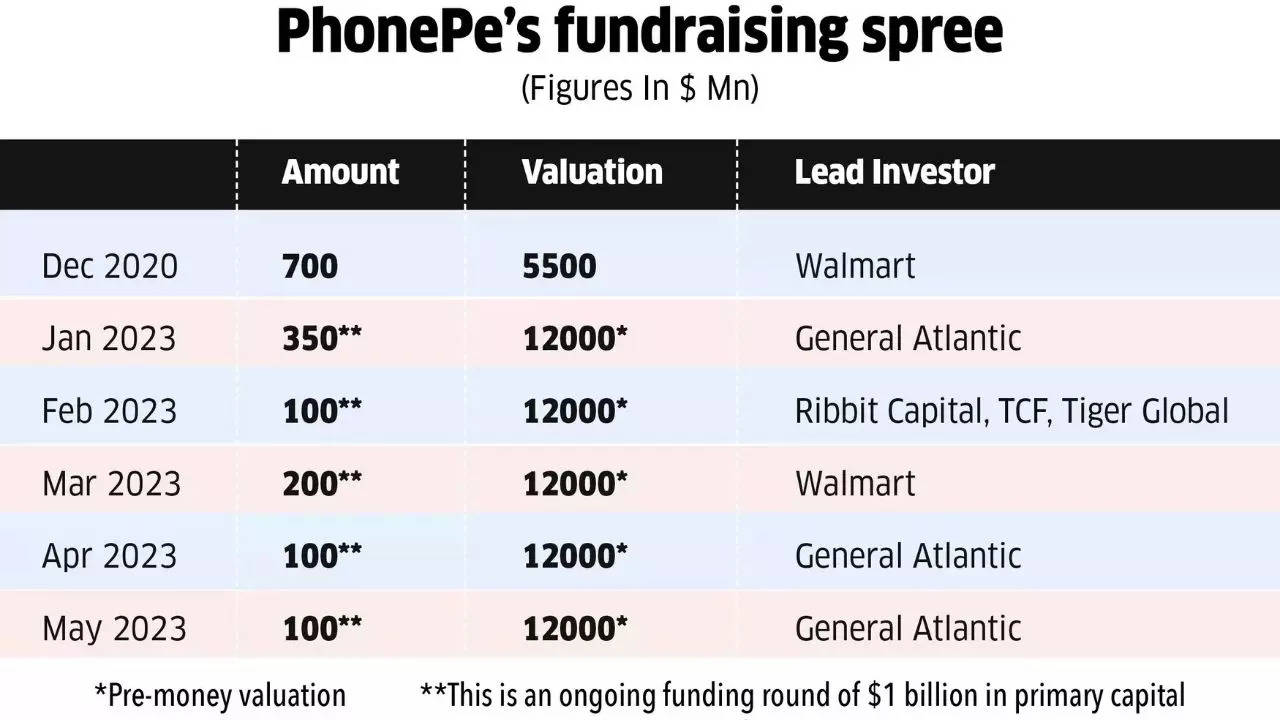

“We concluded an equity fundraising of Rs 7,021 crore from long-term investors like General Atlantic, Walmart, Ribbit Capital, TVS Capital Funds and Tiger Global, pegging PhonePe at a $12 billion pre-money valuation. The fundraise equips us with the required capital to invest behind new businesses which in turn will simultaneously grow and diversify our revenue and profit pools,” the firm said adding that its focus going ahead will be to strengthen its leadership position in the digital payments space while growing the business sustainably and profitably.

EBITDA losses for the fintech firm’s standalone PhonePe India entity which houses its payments business shot up to Rs1,755 crore in FY23 against losses of Rs 1,612 crore reported in FY22.

EBITDA refers to earnings before interest, taxes, depreciation and amortisation. Excluding Esop (employee stock ownership plan) costs, EBITDA stood at a positive Rs159 crore in FY23 compared to losses of Rs 455 crore in the year-ago period. “Substantial Esops were granted in FY23 towards the corporate restructuring and as one-time rewards for setting up and incentivising new business,” the company said.

Flipkart employees were given a one-time payout of around $700 million as part of separation of PhonePe from the Flipkart Group. The Bengaluru-based firm said that its payments business is “moving towards positive EBITDA (before Esop costs).”

PhonePe said that its market share in terms of UPI total payments value (TPV) stood at 50.54% as of March 2023. With a valuation of $12 billion, the firm which is counted as India’s most valued privately held fintech startup shifted its domicile to India from Singapore in the last financial year and also announced its separation from Flipkart.

“We concluded an equity fundraising of Rs 7,021 crore from long-term investors like General Atlantic, Walmart, Ribbit Capital, TVS Capital Funds and Tiger Global, pegging PhonePe at a $12 billion pre-money valuation. The fundraise equips us with the required capital to invest behind new businesses which in turn will simultaneously grow and diversify our revenue and profit pools,” the firm said adding that its focus going ahead will be to strengthen its leadership position in the digital payments space while growing the business sustainably and profitably.