The move is meant to deal with entities such as Google, Facebook and Amazon that use data (“the defining feature of digital markets”) and supplement the Competition Act.It will apply to a list of pre-defined “core digital services” that are susceptible to concentration, the 10-member panel headed by corporate affairs secretary Manoj Govil said.

When it comes to anti-competitive practices, mergers and acquisitions is to be kept out of the proposed law, while in case of nine others the draft legislation has worked out a principle-based framework, laying down the broad contours of each of them.

A parliamentary standing committee report, which had dealt with the issue and has been used extensively by the panel had listed anti-competitive practices such as anti-steering that is seen in app stores and prevents users from tapping into third party apps, or self-preferencing by marketplaces to promote their own products, along with other concerns such as bundling, deep discounting, exclusive tie-ups, search and raking preferences, advertising policies and data usage that allows personal data to be stored by large digital enterprises for profiling customers and sale to others.

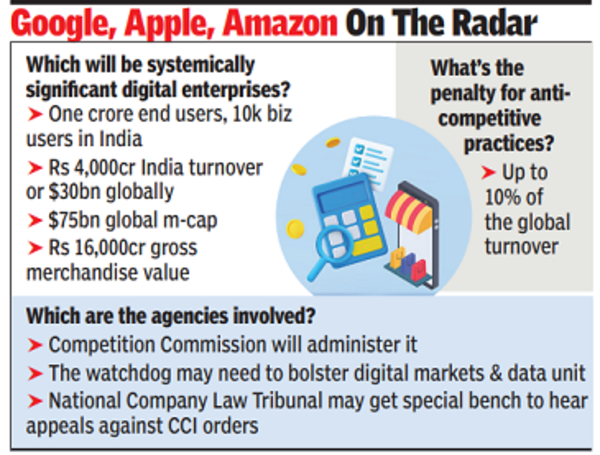

Any contravention of the law will attract a maximum penalty of 10% of the global turnover of the systemically significant digital enterprise (SSDE). Besides, separate penalties have been proposed for contraventions resulting from incorrect reporting and vicarious liability of key management persons.

While identifying SSDEs, the panel has recommended that a mix of significant financial strength test (based on Indian and global market turnover, gross merchandise value) and significant spread test be taken. Entities with one crore end-users or at least 10,000 business users will be part of the significant spread test parameters.

On the turnover in India, a threshold of Rs 4,000 crore has been suggested. But factoring in difficulty faced by CCI in obtaining India-centric data, global turnover of $30 billion has been proposed as the trigger in the law, while $75 billion is the suggested base market cap level. For entities that do not meet the quantitative criteria, a set of qualitative thresholds have also been recommended. While proposing a self-reporting mechanism, an entity will be designated SSDE for three years.

The committee has also recommended a set of associate digital enterprises in case of entities providing core digital services as part of a group. So, the holding company can be designated SSDE, and other entities that are directly or indirectly providing core digital services can be classified as associate digital entities.

“This will have a major impact on the big tech enterprises like Google, Apple, Amazon etc., as they will now also be subject to a separate regulatory regime. Such ex ante regulation could potentially stifle innovation by imposing burdensome regulations on tech companies. This could lead to unintended consequences, such as reduced consumer choice and higher prices,” said Vaibhav Choukse, a partner at JSA Advocates & Solicitors.