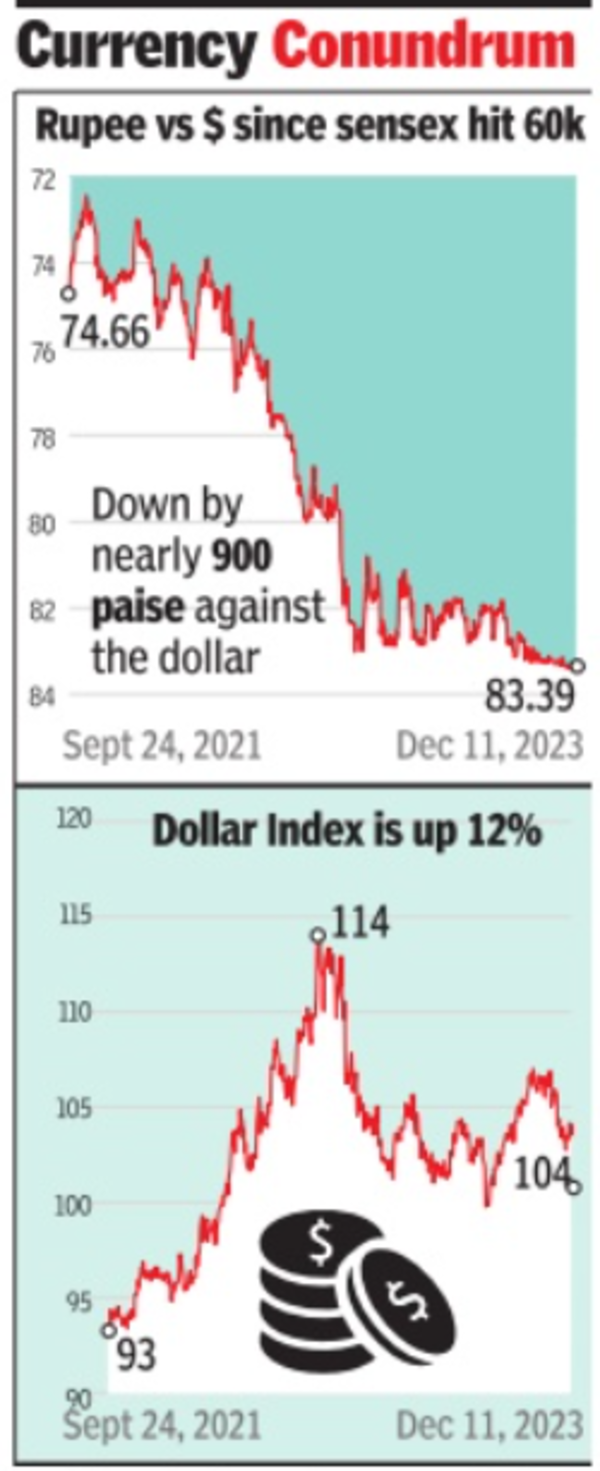

This anomaly occurred recently when the rupee breached 83.39 for the first time on the day the sensex closed at a new high. On Monday as well the rupee closed at its all-time closing low of 83.39 against the dollar even as the sensex breached 70,000 intraday.Two factors have contributed to this phenomenon. First, the surge in domestic investors has maintained elevated stock levels despite foreign institutional investors selling off in several months this year. Although foreign investors shifted to US treasuries as yields approached 5%, mutual funds fuelled by individual investors’ contributions acted as a counterbalance, preventing stock decline. The second factor involves the decoupling of the rupee-dollar from other currency pairs. The rupee has sustained its position while other regional currencies weakened against the dollar. “While there have been flows into debt and equity, this time, the rally has been driven by domestic investors. We have not seen any massive flows from overseas. So every time FPIs sell, the markets have been flat, and every time they buy, the markets rise,” said Ashhish Vaidya, head of treasury, DBS Bank.

One reason why rupee has been steady is that RBI has used its reserves to support the currency. This operation served a dual purpose: to protect the economy from a higher import bill and tighten liquidity by selling dollars, aligning with the central bank’s strategy to raise interest rates and curb inflationdriven demand.

Opinion is divided on whether the rupee could strengthen because of flows. “The likelihood of the rupee getting stronger in the next couple of years is very low. I do not expect the rupee to appreciate against the dollar in the next 12-24 months. Will we see a sharp depreciation? I think not. RBI now has the ability to protect the rupee against volatility,” said Neelkanth Mishra, chief economist, Axis Bank. Proponents of the decoupling theory assert that Indian corporates’ robust earnings, contrary to US and other markets, and inclusion in emerging market bond indices by JP Morgan earlier this year have contributed to this trend.