“India is at an important inflexion point and given the current global developments and associated headwinds, the government should continue to lay major thrust on public capex (on physical, social and digital infrastructure) in the forthcoming Budget,” Ficci said in its Interim Budget recommendations.

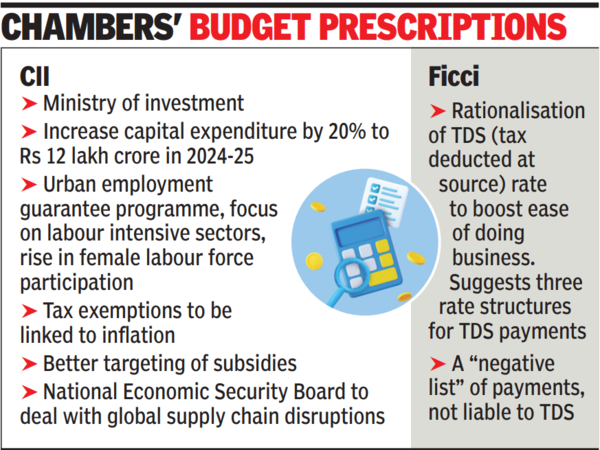

While proposing a ministry of investment, CII has suggested that capital expenditure should be increased by at least 20% to Rs 12 lakh crore during the next financial year. It also wants an urban employment guarantee programme and a focus on labour intensive sectors, such as, apparel and footwear, in addition to steps to increase female labour force participation.

Finance minister Nirmala Sitharaman is due to present the interim Budget on Feb 1, her sixth straight Budget, matching Morarji Desai’s record. While Sitharaman has clearly signalled a transition to the new tax regime, bereft of exemptions and a lower rate, CII wants exemptions to be linked to inflation, which will result in, say, enhancing of Rs 1.5 lakh limit for saving instruments annually.

Similarly, Ficci, which has described the provisions of tax deduction at source (TDS) as cumbersome, has recommended rationalisation of TDS rate to enhance ease of doing business. “It is suggested that there be only three rate structures for TDS payments – TDS on salary at slab rate and two standard rates for TDS for different categories. The standard revenue-neutral rates may be evaluated and worked out by the revenue department based on data analytics. Besides, there should be a “negative list” of payments, which will not be liable to TDS (like payments to senior citizens, exempt income payments, purchases from GST registered entities on which GST is paid, etc),” it said.

CII has also called for better targeting of subsidies, such as those to lower the overall outgo, something which appears unpalatable ahead of the general elections in April-May. The industry lobby group has also suggested establishment of National Economic Security Board to deal with global supply chain disruptions and reduce dependence on sources, which account for large import volumes.