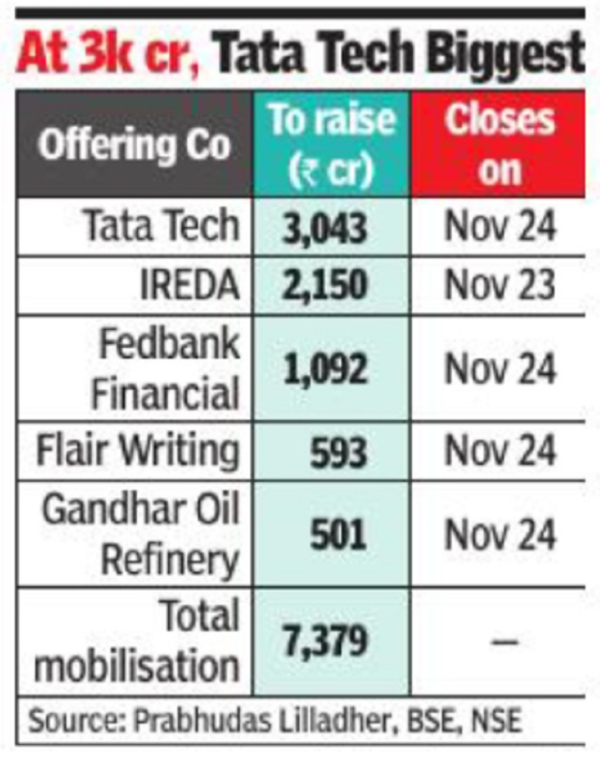

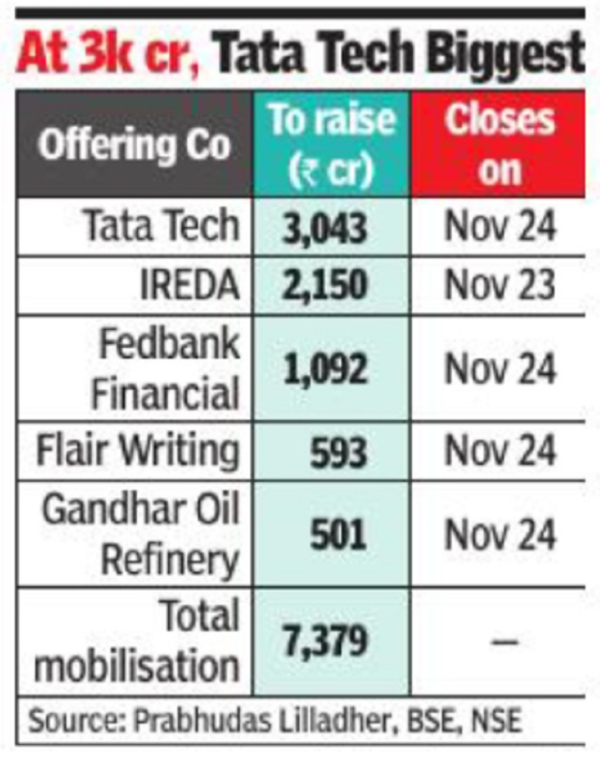

MUMBAI: In one of the busiest weeks for IPOs in years, Dalal Street will see five maiden public offerings, which aim to mobilise nearly Rs 7,400 crore.

With the Rs 3,043-crore offer, Tata Technologies will be the biggest. The other four are: Indian Renewable Energy Development Agency (IREDA), Flair Writing, Gandhar Oil Refinery and Fedbank Financial. While the IREDA issue closes on November 23, the other four are set to close the next day.

With the Rs 3,043-crore offer, Tata Technologies will be the biggest. The other four are: Indian Renewable Energy Development Agency (IREDA), Flair Writing, Gandhar Oil Refinery and Fedbank Financial. While the IREDA issue closes on November 23, the other four are set to close the next day.

On Wednesday, the Tata Tech IPO was subscribed within a couple of hours of opening, and closed the day with a 6.6 times oversubscription.This is the first such offering for aTata Group company in nearly 20 years and there’s strong interest from all categories of investors for it, market players said.

According to Prashanth Tapse, senior VP (research), Mehta Equities, the Tata Tech IPO is high in demand among all kinds of investors due to its legacy and business performance.