The hospital sector was red hot this year, with large hospital chains such as Manipal and Max attracting bulge-bracket investment firms as demand for private healthcare surged post the pandemic.Other growth drivers include a growing ageing population, an increase in lifestyle ailments and rising incomes, which whetted investor appetite with PE firms snapping up established hospital groups and even single specialty hospitals.

“Covid 19 exposed the massive demand-supply gap in India’s healthcare delivery ecosystem and scarcity in motion on all fronts. All formats of healthcare delivery chains, whether multi-speciality, single speciality, day care specialities, have shown tremendous appetite to grow and scale either through the organic or consolidation route. These potential industry tailwinds, growth of health insurance as a payor and the evolution of tier 2 cities as future growth markets have created a strong private equity interest in the sector which has also been matched by the strong demand for hospital stocks in public markets. As one of the fastest growing sectors in one of the fastest growing economies of the globe, we will continue to see phenomenal interest by private equity players in India’s healthcare ecosystem,” Vishal Bali, executive chairman of PE fund, Asia Healthcare Holdings, told TOI.

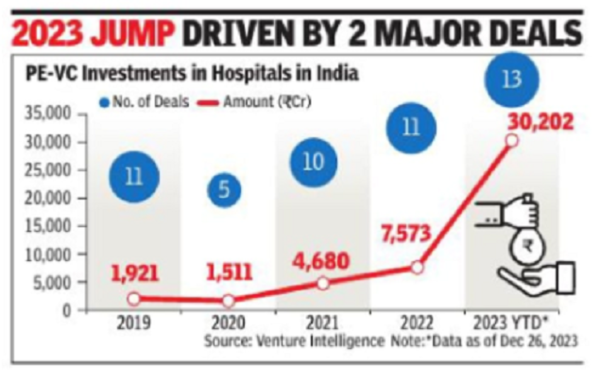

The year witnessed 13 deals, marked by the $2.4-billion Manipal-Temasek mega deal, with Singapore’s sovereign wealth fund increasing its stake in Manipal Hospitals to 59% from 18%. Another big investment was Rs 5,775 crore by Blackstone in Care Hospitals.

“Merger and acquisitions (M&As) is the hottest segment of healthcare today. Finally, global PE firms are making a difference by investing and acquiring large network hospitals. A homogeneous network is of great attraction, and those of size and scale are attracting a premium. Hence, potential values have increased significantly,” Kannan Ramesh, senior partner Somerset Indus Healthcare fund, said.