Latest data released by the finance ministry pegged collections from domestic sources to have increased 13% in December (for transactions in November). While Central and State GST rose by around 14% each, integrated GST – levied on inter-state sales and imports – grew 7.4%, pulled down by imports. IGST on imports is estimated to have increased 3.2%, indicating that the value of shipments into the country remained muted during November.

There was, however, an impressive 27% jump in the cess on imported goods, such as cars, tobacco and coal, indicating that the commodity price drop may not have affected this segment.

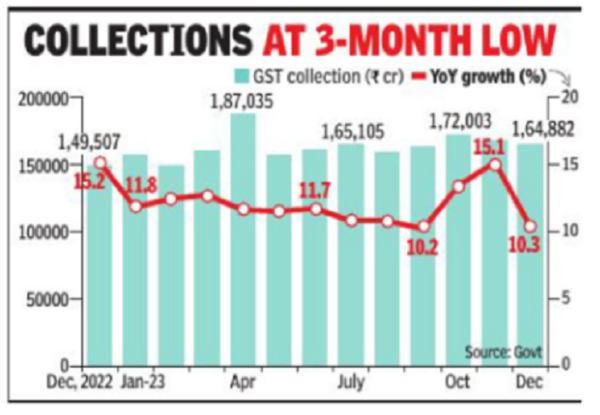

The overall rise reported in December was the slowest since Sept although a part of the collections relates to the Diwali, which was in mid-November.

Analysts are drawing comfort from the monthly average collections of Rs 166,000 crore. “While the collection is slightly lower than those seen last month, the consistent mark of above Rs 1.6 lakh crore provides large fiscal confidence; this being despite the various global headwinds. Festive cheer and continued settlement of FY17-18 and FY18-19 dues would have contributed well to this continued growth,” said Abhishek Jain, partner & national head for indirect tax at consulting firm KPMG.

The trends so far indicate that the Budget target will be exceeded, providing much-needed cushion to the government in meeting higher spending requirements, while sticking to the overall fiscal deficit target as direct tax collections have also remained strong.

“The GST collections for December… shows that the robust collections during the current fiscal are not driven by festive or seasonal reasons but demonstrates the strong underlying economic growth noticed across sectors. With the continuing impressive growth exceeding the fiscal targets for FY24, it is expected that the interim Budget / vote on account expected on February 1 will set higher targets for FY25 as well as set the tone for the next generation of GST reforms,” said MS Mani, partner at Deloitte India.