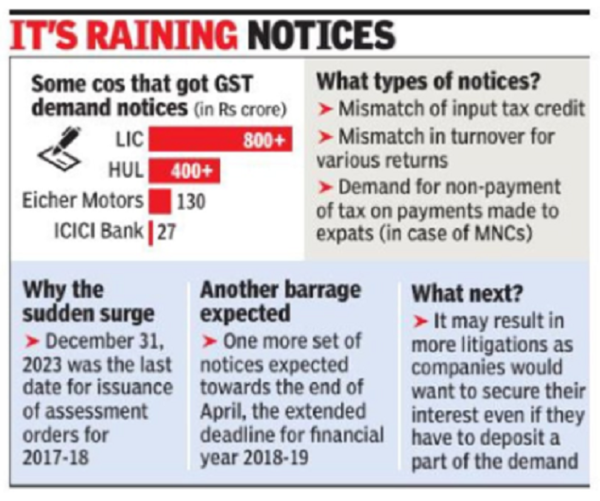

The notices range from mismatch of input tax credit, mismatch in turnover for various returns to demand for non-payment of tax on payments made to expats (in case of MNCs) for which demand has been raised from multinationals despite the confusion over their legality.

For instance, HUL has been slapped with a demand of over Rs 400 crore. “HUL has been proactively compliant in discharging all its GST dues for seconded employees. The company believes it has strong merits to challenge the demand as per the order and will make an assessment to exercise its right to appeal or make submissions before relevant authorities against the order. The order has no material impact on financials as well as no impact on operations or other activities of the company,” a spokesperson said.

Tax consultants said that several MNCs have received similar demand notices.

There is no count on the number of notices as the Centre and state authorities have issued separate orders. According to exchange filings, one large company received five notices between December 30 and 31 from various officers, while another received three between December 29 and 31.

The tax demand ranges from a small portion of an entity’s turnover, which will not cause any material impact, to the entire turnover, which is bound to trigger litigation. For instance, the demand on LIC is over Rs 800 crore, including penalty, while for Eicher Motors it is Rs 130 crore and around Rs 27 crore for ICICI Bank.

“Since December 31, 2023 was the last date for issue of assessment orders for 2017-18 it has resulted in raining of orders on the eve of the new year. Blame lies equally on the doorstep of taxpayers who casually reply to notices without submitting proper evidence before GST authorities,” said tax advocate RS Sharma.

Under the law, cases are “time-barred” and demand has to be raised within five years of filing of final returns. For 2017-18, the notices had to be issued by September 30 and demand orders had to be issued by December 31. Companies stare at the prospect of getting another set of notices towards the end of April, the extended deadline for financial year 2018-19.

“When thousands of notices are issued within a span of few days under pressure of meeting the statutory timeline, details of facts and figures are often missed. Even if a small percentage of these notices culminate into tax demands, the appeal process would entail substantial cash flow issues, given the requirement of pre-deposit of 10% at first level itself. As we go ahead, the authorities should plan in advance so that such last-minute pressure situations are avoided. Also, the GST Council should consider reducing the quantum of pre-deposit required in the appeal process,” said Pratik Jain, partner, Price Waterhouse & Co.

Tax experts said that the current situation is far from the ease of business that was promised. “The spate of GST notices to businesses issued recently will require businesses to extract data for earlier years, reconcile the GST returns with the financials and in many cases the income tax returns as well, all of which will involve significant efforts by the tax and finance teams,” said Deloitte India partner MS Mani.

All this also means more litigation as companies would want to secure their interest even if they have to deposit a part of the demand.

“Given the deadline of normal period of limitation for FY2017-18 and 2018-19, multiple notices have been issued to taxpayers on routine issues like credit mismatch, availment of excess credits, interest/ penalty on disputed tax payments, etc. As a large portion of these notices are on routine matters, an amnesty scheme to settle such matters without any penal implications would be well received by businesses. Also, given a lot of notices were issued on substantive legal issues, proactive clarification by the government would help contain unwarranted litigations at different adjudicating forums,” said Abhishek Jain, indirect tax head & partner at consulting firm KPMG.