NEW DELHI: The Centre is once again set to miss its target for privatisation of state-run companies in the current financial year as the process has nearly stalled, and with general elections on the horizon, the appetite for progress on this crucial policy issue would be limited.

In the past nearly a year, the process has faced several roadblocks, including bureaucratic sloth, hurting several big-ticket public sector enterprises, including privatisation of IDBI Bank.

The Department of Investment and Public Asset Management (DIPAM) had termed 2023-24 as a year of consolidation and had asserted that it would try and complete some of the big-ticket sales, such as, IDBI Bank, logistics firm Concor, BEML, Shipping Corporation of India (SCI). There has been no movement on the proposed stake sales in two state-run banks and one insurance company, although government think tank NITI Aayog submitted its report almost two years ago, recommending Central Bank of India and Indian Overseas Bank for privatisation.

The government had also scrapped privatisation of state-run helicopter services provider Pawan Hans and disqualified the winning consortium led by Star9 Mobility due to several legal cases. This was after many attempts that the Centre took to sell the company.

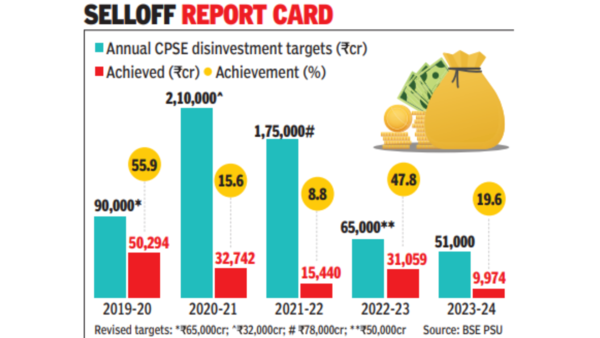

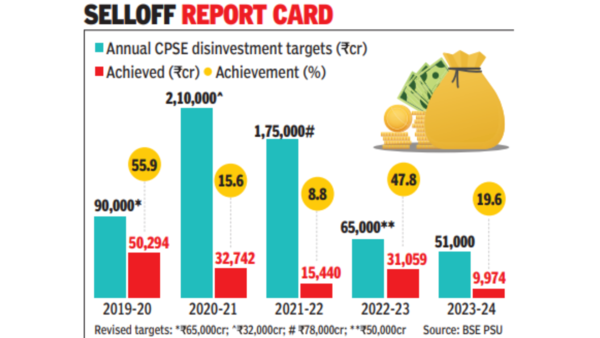

DIPAM has largely been dependent on small transactions on the stock market. It has so far raised Rs 10,050 crore from disinvestment out of the Rs 51,000 crore target and has received dividend worth Rs 40,017 crore so far this year.

In the past nearly a year, the process has faced several roadblocks, including bureaucratic sloth, hurting several big-ticket public sector enterprises, including privatisation of IDBI Bank.

The Department of Investment and Public Asset Management (DIPAM) had termed 2023-24 as a year of consolidation and had asserted that it would try and complete some of the big-ticket sales, such as, IDBI Bank, logistics firm Concor, BEML, Shipping Corporation of India (SCI). There has been no movement on the proposed stake sales in two state-run banks and one insurance company, although government think tank NITI Aayog submitted its report almost two years ago, recommending Central Bank of India and Indian Overseas Bank for privatisation.

The government had also scrapped privatisation of state-run helicopter services provider Pawan Hans and disqualified the winning consortium led by Star9 Mobility due to several legal cases. This was after many attempts that the Centre took to sell the company.

DIPAM has largely been dependent on small transactions on the stock market. It has so far raised Rs 10,050 crore from disinvestment out of the Rs 51,000 crore target and has received dividend worth Rs 40,017 crore so far this year.

The large public sector policy, which was announced with much fanfare, aimed at providing a greater role to the private sector, has also been a non-starter. In fact, officers at DIPAM say “not much is happening” and are waiting for the new government to take office next year for the process to get a fresh lease of life.

DIPAM has been stating that the disinvestment process should not be tied to a particular revenue target and instead should focus on the quality of transactions.

With direct tax and GST collections remaining buoyant, the focus has been less intense on privatisation, always a political hot potato.