“If you look at the 11 months period of the financial year this is the highest export growth which we have achieved, both merchandise as well as overall.This is very heartening,” commerce secretary Sunil Barthwal told reporters. The numbers have also given govt the confidence that last year’s level will be scaled.

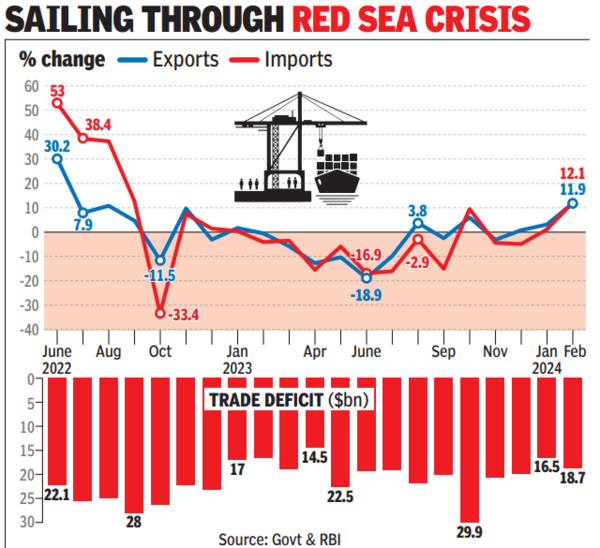

Economists too sounded upbeat. “The surprise to our estimate came from a better-than-expected goods export performance. This suggests that the disruptions to the Red Sea trade route, while requiring some re-routing of India exports, have not materially altered the trend in exports,” Barclays said in a note. Services exports in Feb hit a record of $32.1 billion, 17.3% higher than a year ago, while trade surplus also hit a monthly high of $16.7 billion.

On the goods side, engineering goods, the country’s largest export item, was a key driver in Feb, growing 15.9% to $9.9 billion. “In the past few months, there has been a revival in various commodity groups, especially iron and steel. Also, demand from various markets such as Australia, UAE, and Russia has been reasonably good and the trend is expected to continue… We are optimistic that FTAs with the UK, Oman, and the EU would be signed sooner than later,” EEPC India chairman Arun Kumar Garodia said.

Electronic goods, largely mobile phones, saw a 55% jump to almost $3 billion. While sectors such as gems and jewellery were impacted by weak demand overseas, petroleum (5% rise to $8.2 billion) and readymade garments (4.9% increase to $1.5 billion), adding to the overall increase.

“Such an impressive increase in overall exports growth, despite the Red Sea crisis, tight monetary stance by the developed world and falling commodity prices posing challenge, not only portrays the dedication and commitment of the sector but also the resilience of the exporting community, who have continuously been braving such odds since Russia-Ukraine war,” Fieo president Aswani Kumar said.

On the import front, gold shipments soared 2.3 times to $6.1 billion in February, silver surged to over $1.7 billion in February, compared with $13 million a year ago. The yellow metal has been flirting with new highs in recent weeks, both in the domestic and international market. Crude petroleum, however, remained flat at $16.9 billion.