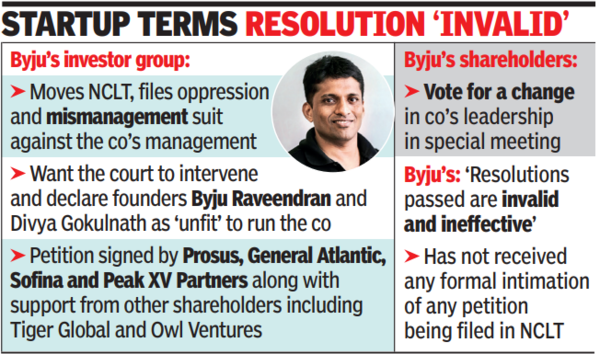

The announcement by investors led by Prosus, came hours after it emerged that a group of four investors had moved the Bengaluru bench of the National Company Law Tribunal, seeking the declaration of the founders as “unfit” to run the entity, citing “oppression and mismanagement”.They want the tribunal to order the appointment of a new CEO and board and declare the $200 million rights issue as void.

The petition signed by Prosus, General Atlantic, Sofina and Peak XV Partners, along with support from other shareholders including Tiger Global and Owl Ventures, was filed to “prevent value erosion for all shareholders as well as preserve worth for other stakeholders-employees and customers”, investor sources said.

“At today’s EGM, shareholders unanimously passed all resolutions put forward for vote. These included a request for the resolution of the outstanding governance, financial mismanagement and compliance issues at Byju’s; the reconstitution of the board of directors so that it is no longer controlled by the founders of T&L (Byju’s parent Think & Learn) and a change in leadership of the company,” Prosus said in a statement on Friday. These investors collectively hold over 60% in the firm voted in favour.

Responding to it Byju’s said the resolutions passed during the EGM, which it claimed was attended by a small cohort of select shareholders, were invalid and ineffective. “These resolutions were voted upon without the valid constitution of a quorum as stipulated in Byju’s Articles of Association (AoA). As the founders did not participate in the meeting, the quorum was never legitimately established, rendering the resolutions null and void,” it said, adding that they lacked the necessary authority to impose any obligations on Byju’s or its directors.

Byju’s also said that it has not received any formal intimation of any petition being filed in the NCLT. “If such a petition has been filed, the company shall respond to the same as per applicable law and due process,” a company spokesperson said.

Earlier this week, the startup managed to gain a temporary reprieve from the Karnataka high court which passed an interim order stating that any decisions taken by the shareholders in the EGM should not be given “effect to” until the matter is heard on March 13.

“As shareholders and significant investors, we are confident in our position on the validity of the EGM meeting and its decisive outcome, which we will now present to the Karnataka HC in line with due process,” Prosus said.

Once a high flying startup, Byju’s has lost the trust of its investors following a series of financial and corporate governance lapses at the firm. Through the NCLT petition, investors are also seeking a forensic audit and a directive to the company against taking any corporate actions that will prejudice the rights of the investors.

In their suit, the investors have raised concerns around the “oppressive nature” of the rights offer, financial mismanagement by the founders leading to the loss of control of its profit making test-prep unit Aakash Educational Services, regulatory non-compliances and “oppressive opacity and wilful default” in sharing information with stakeholders. They have also highlighted prolonged corporate governance issues including non-hiring of a CFO and independent director, and default on term loan B payments.