While the Centre’s decision to rework the way it released funds is estimated to have helped it save around Rs 10,000 crore during the last financial year, the amount is expected to go up significantly this year as the free float has come down sharply, government officials said.

It has, however, spelt bad news for banks that were generating large amounts of free cash from government departments and agencies but now has to deal without it. In fact, some of the public sector players had taken up the issue with the finance ministry, only to be ticked off, officials told TOI.

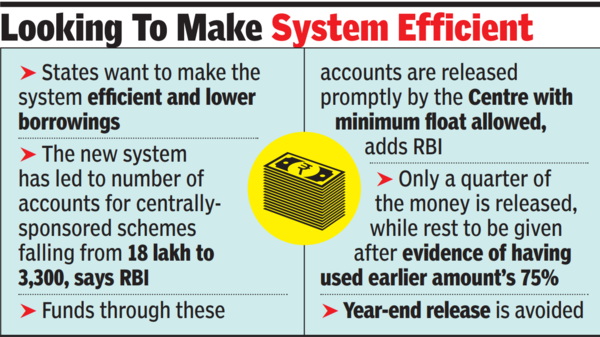

The Centre has gone about the task in a calibrated manner to reduce the number of fragmented banking arrangements, which results in inefficient cash management, which often left certain agencies short of funds, while others were sitting on idle money. This often resulted in the government having to resort to short-term borrowing, which imposed an additional interest burden.

So, the Centre moved to a Treasury Single Account with close to 200 autonomous bodies receiving funds through this account maintained with the Reserve Bank of India. Similarly, two other accounts – central nodal agency system for central schemes and single nodal agency model for centrally sponsored schemes were opened.

The new system has resulted in the number of accounts for centrally sponsored schemes falling from 18 lakh to 3,300, the RBI noted.

In its latest state finances report, RBI has noted how funds through these accounts are released promptly by the Centre with minimum float allowed. This is because only a quarter of the money is released with the rest to be given only after evidence of using the earlier 75% is given. Further, year-end release is avoided.

A further improvement has been made as the Centre keeps track of on a real-time basis through a dashboard. In its report, RBI has listed several gains for states and said: “Overall, the ability to see the transaction process end-to-end improves the efficiency of the delivery mechanism.” Sources said that several states are also moving towards a similar mechanism for fund release, while some have already made a start as they see merit in the new system.