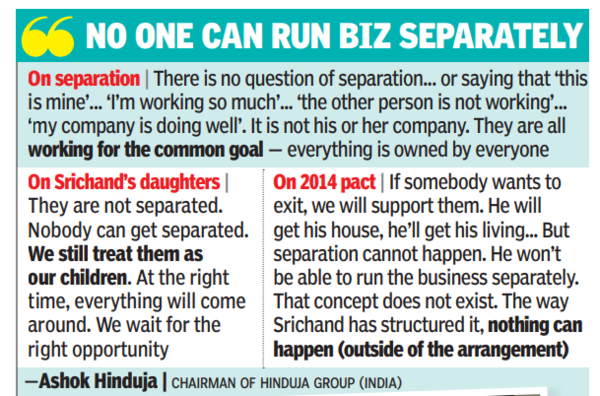

“There is no question of separation… or saying that ‘this is mine’… ‘I’m working so much’… ‘The other person is not working’… ‘My company is doing well’.It is not his or her company. They are all working for the common goal – everything is owned by everyone,” Ashok Hinduja (73), the youngest son of P D Hinduja and chairman ofHinduja Group (India), told TOI here, in the presence of Gopichand (83) – who is the chairman of the conglomerate – and Prakash (78).

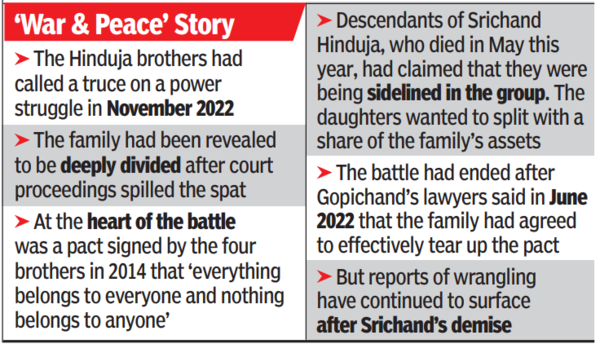

The family’s guiding principle, “everything belongs to everyone, and nothing belongs to anyone”, was at the centre of the pact signed by the four brothers in 2014. The pact subsequently became the seed for a long-drawn legal battle. Though the family in 2022 called a truce in view of the failing health of Srichand Hinduja – the eldest of P D Hinduja’s four sons – reports of wrangling have continued to surface aftermath his demise (in May this year). The core of discord in the Hinduja clan, which spans over four generations, has been an allegation by Srichand’s daughters claiming they are being sidelined by the uncles, and hence, keen to split with a share of the family’s assets.

“They (Srichand’s children) are not separated. Nobody can get separated. We still treat them as our children. At the right time, everything will come around. We wait for the right opportunity,” Ashok said. The traditionally tightly knit family has more than three dozen members, with some working for the group while others pursue interests outside of the conglomerate. This makes division of the assets among family members a challenge.

“If somebody wants to exit, we will support them. He will get his house, he’ll get his living, he’ll get everything. But separation cannot happen. He won’t be able to run the business separately. That concept does not exist in the group. The way Srichand has structured it, nothing can happen (outside of the arrangement),” Ashok added.

Describing the group’s functioning, the brothers said that members of the family meet regularly to discuss various issues related to the conglomerate, and everyone is apprised of everything. “If you ask Dheeraj (Gopichand’s son), who is involved with Ashok Leyland, about the group’s other sectors, he knows about them. If you ask Shom (my son), who led the group’s foray into renewables, he, too, knows about other sectors. Everybody sits together, works on future plans, investments and everything,” said Ashok.

With the third generation already in the system for over a decade, the three Hinduja brothers are making plans for the fourth-gen. “Within the next generation, who are aged around 23-24, someone is interested in pharma, another is interested in art. All opportunities are available (for the conglomerate to diversify). Whoever wants to do whatever, where they can show their calibre, is welcome – but everybody has to do it for the group. Nobody can say, ‘this is mine and I’m doing it for myself’,” said Ashok.

“The family supports individual member’s business initiatives that will help in expanding the conglomerate,” Prakash, chairman of Hinduja Group (Europe), added. The trio plans to park the Hinduja brand in a trust so that all group companies pay a brand royalty fee to the entity. “The process is on. We haven’t yet decided on the jurisdiction of the trust,” said Ashok.

Talking of the group’s future plans, the brothers said the family will focus on the conglomerate’s shift towards electric mobility, clean energy and fintech, among others, in sync with the changing business environment. The group is also doubling down on financial services, after emerging as the sole bidder for Reliance Capital. Ashok said there are still gaps in financial services like mutual funds, which the group may fill up through acquisitions.

The conglomerate has routed the Reliance Capital bid through IndusInd International Holdings, a Mauritius-based entity, which is also the promoter of IndusInd bank. There are more than 600 shareholders in IIHL and many are looking to exit the company. Ashok said the plan is to do an IPO of IIHL in an overseas jurisdiction. However, amid all the big-buck plans, it remains to be seen whether the brothers can contain the family’s power struggle, which puts at stake one of the world’s biggest conglomerates that employs more than 200,000 people globally.